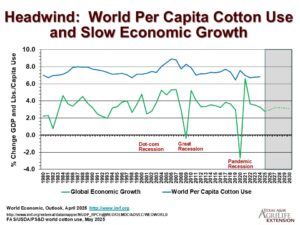

The forecast of cotton demand is generally influenced by macroeconomic conditions. The blue line in the figure below measures annual per capita cotton consumption. The amount ranges between six and eight pounds per person per year, or roughly a half a dozen cotton shirts. Visually, per capita cotton consumption varies directly with the growth of the world economy (measured in percent by the green line). The underlying story is fairly straightforward. During economic expansions, consumers buy more cotton apparel and home furnishings. However, fewer of these discretionary, semi-durable purchases are made during recessionary periods.

So are we in a recessionary period, or likely to enter one? That that question is a current matter of debate among economists. The IMF economists that produced the green line forecast above are projecting low, slow growth. Meanwhile per capita cotton consumption is currently at the low end of the historical range. During 2025 there have been numerous economic forecasts, like this one, which associate tariff policy uncertainty with lower GDP, which again is a bad open for cotton demand.

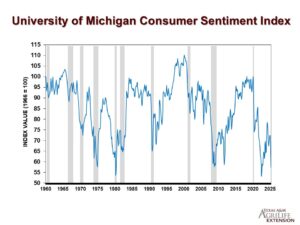

The current bearish outlook for cotton demand is reinforced by measures of consumer sentiment, shown below.

Another cautionary consideration is the effect of central bank policy to stimulate the economy or fight inflation (click here for a more general discussion of interest rates and commodity prices). The figure below shows the rise and partial fall of U.S. inflation (measured by the year-over-year change in monthly Consumer Price Index). The red numbers indicate quarter, half, or three quarter percent increases in federal funds rate by the U.S. Federal Reserve. The federal funds rate influences overnight lending by U.S. banks, and hence throughout the U.S. economy. These interest rate hikes have apparently succeeded in reducing inflation. However, the Federal Reserve’s target rate of inflation is 2%, so these higher interest rates may persist for a while. In general, higher interest rates slow economic growth, which could prove a headwind for cotton consumption (as discussed above).

An automotive analogy to the interest rate chart above is that the Federal Reserve took their foot off the economic accelerator just before inflation bottomed. The raising of interest rates is analogous to pumping the brakes to deliberately slow the economy. Again, this represented a potential headwind to cotton consumption. Now, as of September of 2024, the U.S. Federal Reserve has taken interest rate cuts (a half percent cut in the first instance). The Fed did it again in September, 2025, thus taking their foot off the accelerator again. This raises the possibility of a boost to GDP and cotton demand, all other things being equal.