It is never too early to develop a marketing plan for the next crop year.

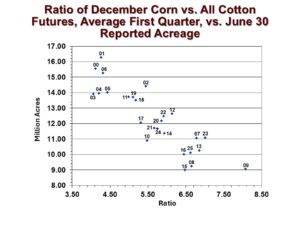

Longer run price outcomes for the 2026 crop depend on expectations of supply and demand. The first supply-related question is how much acreage will be planted. The price of competing crops, relative to cotton prices, is an important consideration to the level of planted acreage. The chart below shows a fairly strong relationship between the level of U.S. upland and pima cotton planted (as measured on June 30) and the ratio of December CBOT corn futures and ICE cotton futures during the first quarter of the year. The higher the ratio, the less cotton is planted, all other things equal. Of course, there are other important competing crops as well: sorghum, soybeans, peanuts, and perhaps wheat. And there are other non-price influences, including how dry it is in Texas, the insurance base price, fixed cost influences, and the psychological influence of the preceding growing season. But the price ratio of corn to cotton appears to capture a lot of these other influences in explaining variations in cotton plantings.

What does the above chart imply for 2026? As of late October, the Dec’26 CBOT corn/Dec’26 ICE cotton price ratio is around 6.7 (i.e., $4.58 corn divided by 68-cent cotton). Assuming this ratio prevails during Q1 of 2026 , it is historically associated with between 10.0 and 10.5 million acres of all cotton.

Assuming 10.0 million acres of all cotton in 2026, and further assuming ten-year Olympic averages of U.S. all cotton abandonment (21%) and yield (869 lbs) per harvested acre, the result is a healthy crop of 14.3 million bales. This combines with NASS’s projection of 3.6 million bales of carry-in for a 17.9 million bale supply. Further assuming 14.2 million bales of total use, the result is under four million bales of ending stocks of U.S. cotton in 2026/27. That outcome is neutral for prices as it represents static year-over-year ending stocks.

Caveats. Obviously, the analysis above depends on price ratios which may change between now and early 2026. Furthermore, the price ratio approach to forecasting planted acreage will be replaced by grower survey results, beginning at Beltwide (January 7) and continuing with the NCC’s survey release (February 9) and USDA’s Prospective Plantings report (March 31) and Acreage report (June 30).

NOAA’s Climate Prediction Center indicates La Niña drought possibilities lasting into Q1. This implies that the currently dry situation could persist or worsen with higher abandonment (and perhaps also higher plantings) than currently assumed. This could greatly reduced the level of harvested acreage and resulting production, which could contribute to a more volatile weather market during Q1 and Q2. For example, the La Niña-then-neutral forecast even allows for the possibility of an above average crop planting followed by timely rains in Q2 or Q3, leading to unexpectedly higher production and weaker prices.