USDA won’t publish new crop cotton balance sheet projections until the winter. Still, it is never too early to begin the planning process.

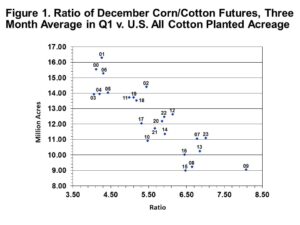

The first question to answer is the level of 2024 production, with an emphasis on acreage. The price of competing crops, relative to cotton prices, is an important consideration to the level of planted acreage. The chart below shows a fairly strong relationship between the level of U.S. upland and pima cotton planted, as measured on June 30, and the ratio of December CBOT corn futures and ICE cotton futures during the first quarter of the year. The higher the ratio, the less cotton is planted. Of course, there are other important competing crops as well: sorghum, soybeans, peanuts, and perhaps wheat. And there are other non-price influences, including how dry it was in Texas, the insurance base price, fixed cost influences, and the psychological influence of the preceding growing season. But the price ratio of corn to cotton appears to capture a lot of these other influences in explaining variations in cotton plantings.

What does the above chart imply for 2024? Through March 22, the average Dec’24 corn/cotton ratio in the first quarter of 2024 is 5.76. This level is historically associated with between 11.5 and 12.5 million acres of all cotton (upland and pima combined), assuming this ratio persists into Q1 of 2024. By then we will begin to have milestone acreage survey results from the ag media, the National Cotton Council, and USDA. Meanwhile USDA forecasted planted acreage of 11.0 million at their February 16 Outlook Forum.

The long term demand question is perhaps the most uncertain part of this exercise. USDA has been assuming robust demand in the current 2023/24 marketing year, and they are continuing to for 2024/25. I hope that is true and that it continues into 2024/25. But I am cautious about the possibility of macro headwinds related to world GDP, inflation, and central bank policy. Slipping into a recession is a possible risk that is historically associated with declining cotton demand. Short of that, just having low, slow growth in the world economy could deprive the cotton market of sustained price support, leaving only the volatile and short lived weather market influence discussed above.